Why Index Funds Are Ideal for Long-Term Coast FIRE Growth

When it comes to building long-term wealth for Coast FIRE, few investment vehicles are as powerful, simple, and stress-free as index funds. They don’t promise overnight riches. They don’t require day-trading skills. And best of all—they just work.

If you’re aiming to hit your Coast FIRE number and let compound growth carry you the rest of the way, index funds might be your best financial ally.

Ready to find out your Coast FIRE number? Try the free Coast FIRE Calculator and take control of your financial future today.

What Are Index Funds?

An index fund is a type of mutual fund or ETF (exchange-traded fund) designed to track the performance of a market index, such as:

- The S&P 500

- The Total U.S. Stock Market

- The NASDAQ-100

Instead of trying to beat the market, index funds match it—which, surprisingly, beats most actively managed funds over time.

That “average market return” (typically 7–10% annually over the long term) is perfectly suited for the Coast FIRE strategy.

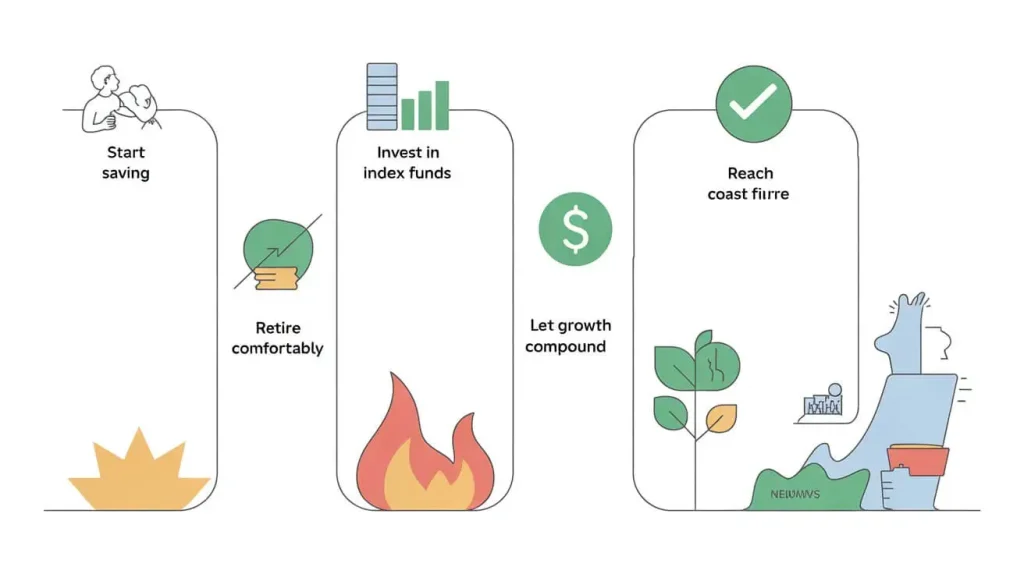

Why Index Funds Work So Well for Coast FIRE

Coast FIRE relies on two things:

- Front-loading your investments early in life

- Letting compound growth do the heavy lifting over the next few decades

Index funds are ideal for this because they offer:

- Low fees (often 0.03%–0.15%)

- Diversification across hundreds or thousands of companies

- Minimal effort—you don’t have to pick winning stocks

- Historical consistency of long-term growth

Let’s explore these advantages in more detail.

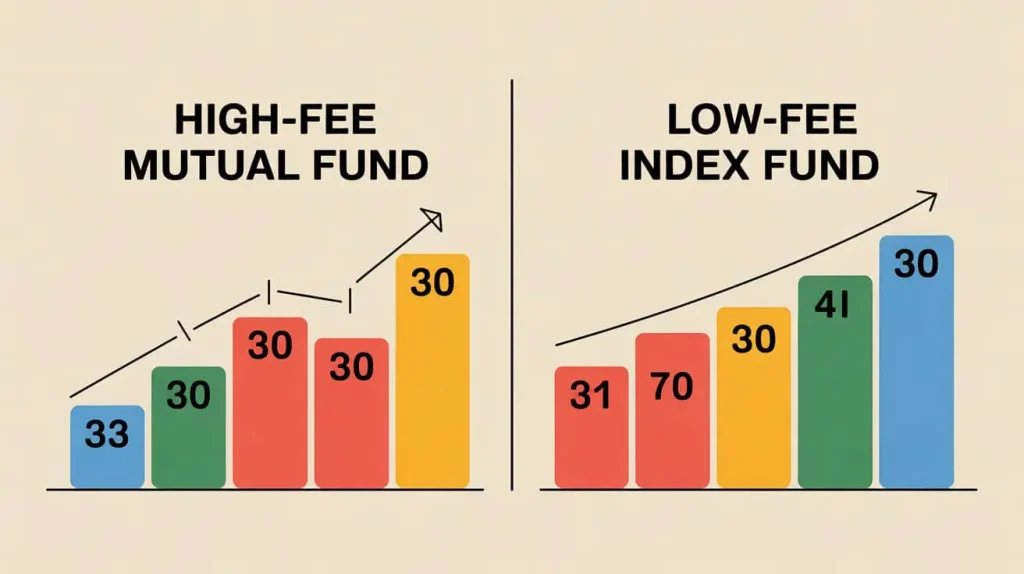

1. Low Fees Maximize Your Long-Term Returns

High fees eat into compound growth over time. For someone pursuing Coast FIRE, where decades of growth matter, this is a deal-breaker.

Compare this:

- Actively managed mutual fund: 1%–2% fee

- Index fund: as low as 0.03%

That difference might not sound huge—until you realize it could cost you hundreds of thousands of dollars over 30–40 years.

Keeping your investment expenses low is one of the easiest ways to retire earlier.

2. Broad Diversification = Lower Risk

Index funds don’t bet on one company—they spread your investment across hundreds or even thousands of businesses.

This reduces the risk of:

- A single stock dragging down your portfolio

- Emotional panic-selling during market swings

- Missing out on growth from sectors you didn’t consider

Diversification is a built-in safety net, and that makes index funds a stress-free choice for long-term investing.

3. “Set It and Forget It” Mentality Supports Long-Term Goals

One of the underrated benefits of index funds is peace of mind. You don’t need to track earnings reports, follow stock charts, or guess what the market will do next.

This aligns perfectly with the Coast FIRE approach:

✔ Save early

✔ Invest wisely

✔ Let it grow

Index funds let you coast—both financially and emotionally.

4. Perfect Fit for Dollar-Cost Averaging

If you’re contributing monthly or biweekly toward your Coast FIRE goal, index funds are the best way to implement dollar-cost averaging.

This simply means investing a fixed amount at regular intervals, regardless of market conditions. Over time, this strategy:

- Reduces the impact of volatility

- Encourages consistency

- Smooths out your average purchase price

Consistency is the real driver behind Coast FIRE—and index funds make that easy.

5. Easy to Automate and Track

Nearly every investment platform (Fidelity, Vanguard, Schwab, etc.) lets you:

- Set up automatic contributions

- Reinvest dividends

- View performance anytime

This makes it simple to stay on track and monitor how close you are to your Coast FIRE number.

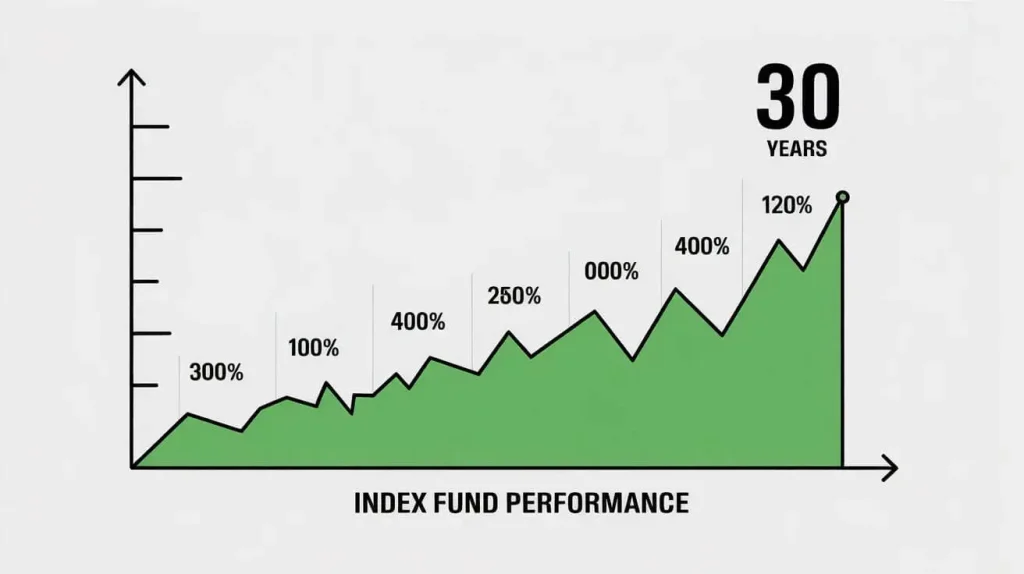

6. Historical Performance Supports FIRE Timelines

Looking back over the last century, the U.S. stock market has returned around 7% annually after inflation. Index funds that track major indices like the S&P 500 have consistently followed this trend.

That means if you invest aggressively in your 20s and early 30s, you can often stop contributing by your late 30s or early 40s and still retire comfortably in your 60s—just by letting your investments grow.

This is the core logic behind Coast FIRE.

Most Popular Index Funds for FIRE Investors

If you’re ready to invest in index funds, here are some of the most popular, low-fee options:

| Fund | Type | Expense Ratio |

|---|---|---|

| VTSAX | Total US Stock Market (Vanguard) | 0.04% |

| VFIAX | S&P 500 Index (Vanguard) | 0.04% |

| FZROX | Total US Stock Market (Fidelity) | 0.00% |

| SWTSX | Total US Stock Market (Schwab) | 0.03% |

| VT | Global Market (Vanguard ETF) | 0.07% |

Make sure you research each one and choose based on your own risk tolerance and timeline.

Final Thoughts: Simplicity Wins in the Long Run

Coast FIRE isn’t about getting rich overnight—it’s about achieving financial peace of mind as early as possible, and letting your money grow while you live your life.

Index funds are the perfect vehicle for that journey.

They’re low-maintenance, low-cost, and historically reliable. They let you invest without stress—and coast without fear.

Want to know how close you are to your Coast FIRE number? Use the Coast FIRE Calculator to start building your path to freedom today.