Understanding Compound Interest in the Coast FIRE Journey

If there’s one financial concept that fuels the entire Coast FIRE journey, it’s this: compound interest.

Albert Einstein reportedly called it the “eighth wonder of the world.” Whether he said that or not, there’s no doubt—it’s the engine behind long-term wealth creation. And if you’re aiming for Coast FIRE, understanding how compound interest works (and how to maximize it) is essential.

In this article, we’ll break down what compound interest is, why it’s the backbone of the Coast FIRE strategy, and how to make it work harder for you—without working harder yourself.

Want to know how much you need to reach Coast FIRE? Use the free Coast FIRE Calculator to get your number instantly.

What Is Compound Interest, Really?

At its core, compound interest is when you earn interest not just on your original investment—but also on the interest your investment has already earned.

In other words:

You earn interest on your interest.

And that’s where the magic lies.

A Simple Example:

Let’s say you invest $10,000 in an index fund earning 8% annually:

- Year 1: $10,000 → $10,800

- Year 2: $10,800 → $11,664

- Year 3: $11,664 → $12,597

By Year 10, that $10,000 becomes $21,589—more than doubling, even if you don’t add a single dollar. The longer it grows, the faster it accelerates.

That’s the compounding effect, and it’s the reason time > money when it comes to investing.

Why Compound Interest Is the Foundation of Coast FIRE

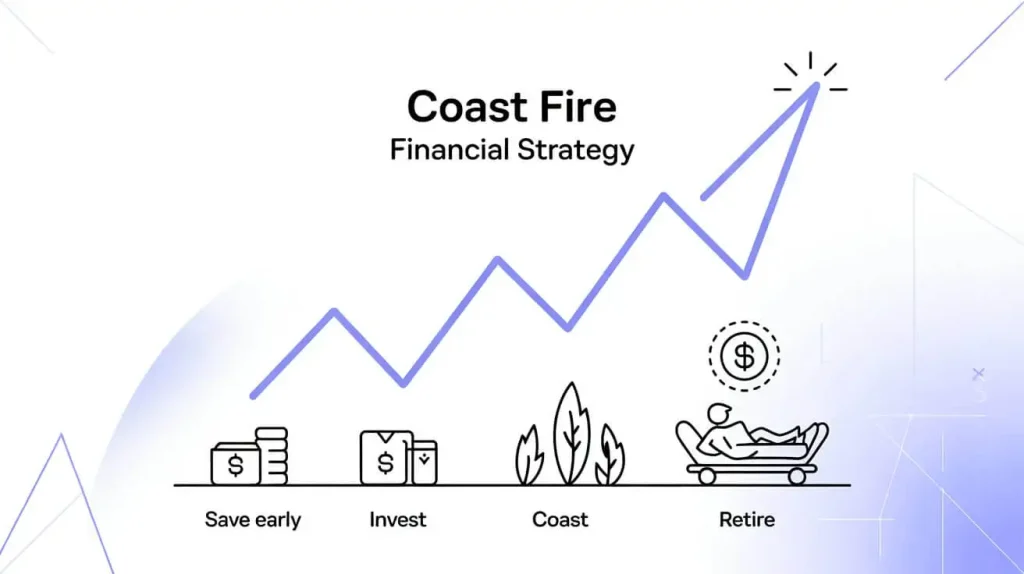

Coast FIRE is all about investing early and letting compound growth do the heavy lifting. Once you hit your Coast FIRE number, you no longer need to contribute to retirement savings—your existing investments will grow on their own to fund your retirement.

This makes compound interest the central pillar of the strategy.

Here’s how they work together:

- You front-load your investments in your 20s or 30s

- You stop contributing once you reach your Coast FIRE number

- Compound interest grows your portfolio over the next 20–30 years

- You “coast” to retirement without needing to save more

The earlier you start, the less you have to invest—and the more your money does the work for you.

The Math Behind Compound Growth

Compound Interest Formula:

A = P × (1 + r/n)^(nt)

Where:

- A = Final amount

- P = Principal (initial investment)

- r = Annual interest rate

- n = Number of times interest is compounded per year

- t = Number of years

While this formula might seem complex, the big takeaway is simple:

Time + Consistency = Wealth

Even if you invest modestly, starting early makes a massive difference.

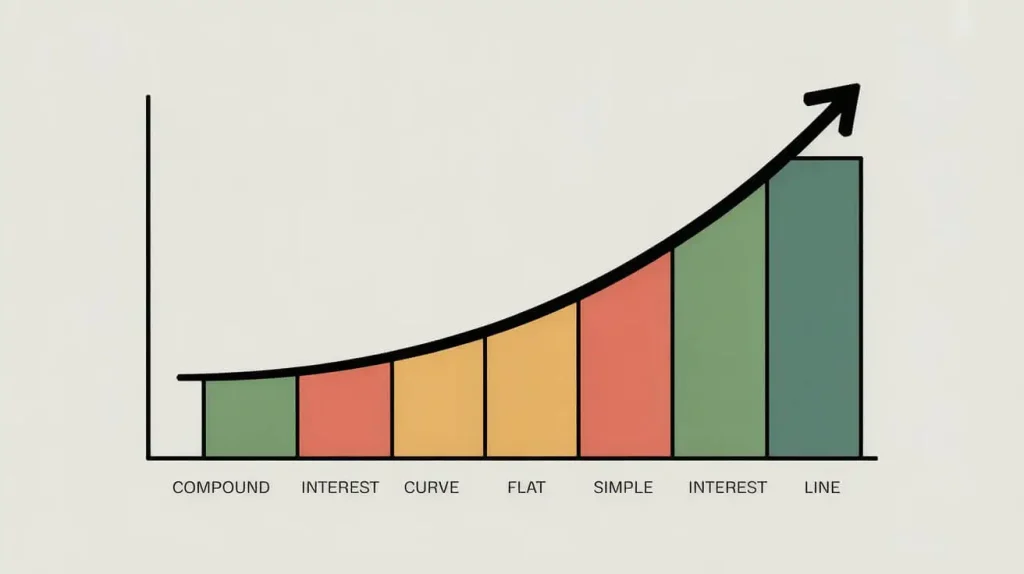

Compound Interest vs. Simple Interest

| Interest Type | How It Works | Example (10 years @ 8%) |

|---|---|---|

| Simple | Earned only on original investment | $10,000 → $18,000 |

| Compound | Earned on original + earned interest | $10,000 → $21,589 |

Over 30 years, the difference is tens or hundreds of thousands of dollars. That’s why compound interest is Coast FIRE’s best friend.

Real-Life Coast FIRE Example

Let’s say you’re 28 years old, and you invest $75,000 in low-cost index funds. You’ve calculated that you no longer need to save for retirement—just cover your living expenses going forward.

Assuming a 7% annual return:

- In 20 years (age 48): ~$289,000

- In 30 years (age 58): ~$569,000

- In 35 years (age 63): ~$800,000+

That’s without investing another dollar. That’s the power of compounding in action.

5 Ways to Maximize Compound Interest on the Coast FIRE Path

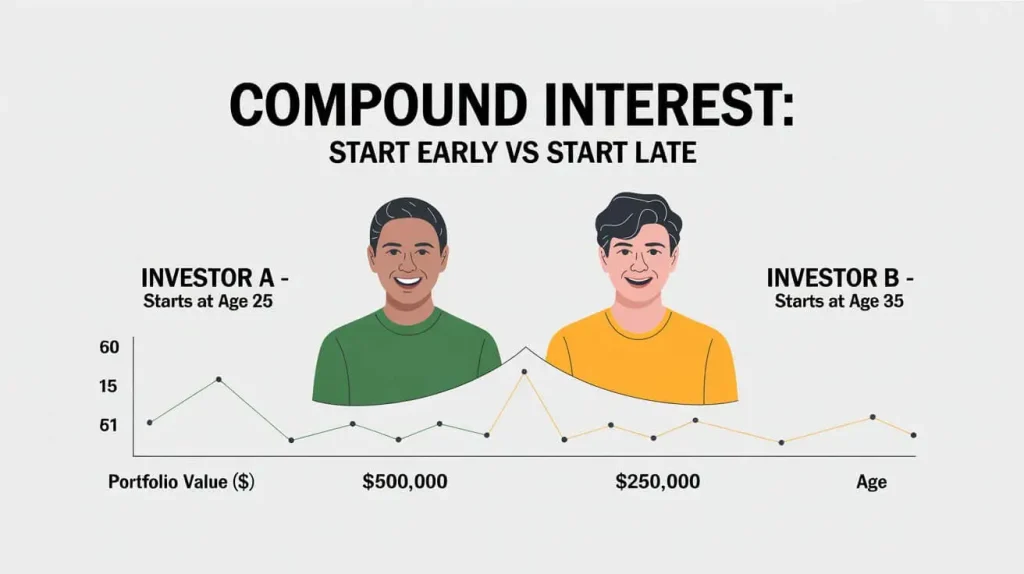

1. Start Early

Even a few years can make a huge difference. Investing at 25 instead of 35 can double your future wealth with the same contributions.

2. Invest Consistently Early On

Coast FIRE requires a front-loaded strategy. Focus on saving and investing as much as possible in your early earning years.

3. Choose Low-Fee Investments

High fees eat into compounding. Index funds and ETFs with expense ratios under 0.10% are ideal.

More on this: Why Index Funds Are Ideal for Long-Term Coast FIRE Growth

4. Reinvest Dividends Automatically

Dividends are a hidden engine of compound growth. Make sure they’re reinvested instead of sitting in cash.

5. Stay Invested Through Market Cycles

Don’t try to time the market. Miss the best days, and you lose compounding momentum. Stay in and stay steady.

Common Misconceptions About Compound Interest

❌ Myth 1: “I can start later and just invest more.”

🟢 Truth: You’ll have to invest a lot more to make up for lost time.

❌ Myth 2: “It’s too late for me.”

🟢 Truth: Compound interest works at any age—just with different strategies.

❌ Myth 3: “It’s all about how much I earn.”

🟢 Truth: What matters most is how much you save and how long it grows.

Final Thoughts: Compound Interest = Coast FIRE’s Superpower

Coast FIRE isn’t about being rich—it’s about reaching a point where your money grows faster than your need to earn it. That’s what compound interest makes possible.

It rewards those who start early, stay consistent, and keep things simple.

Want to see how compound interest can carry you to Coast FIRE? Use the Coast FIRE Calculator to map your financial future today.