Real-Life Coast FIRE Stories: How People Reached Financial Independence Early

It is easy to get lost in the math of financial independence. We spend hours tweaking the variables on the Coast FIRE Calculator, staring at compound interest graphs, and debating safe withdrawal rates.

But numbers on a screen are just pixels. The true power of Coast FIRE (Financial Independence, Retire Early) isn’t found in a spreadsheet row; it is found in the stories of real people who woke up one day and realized they had enough.

Unlike traditional retirement, where you work for 40 years and then stop abruptly, Coast FIRE is the realization that you have saved enough in your early years that compound interest can cover your retirement funding. This unlocks a superpower: you no longer need to save for the future. You only need to earn enough to cover your current bills.

This shift allows people to quit high-stress jobs, travel the world, spend time with their kids, or pursue passion projects in their 30s and 40s.

Below, we explore three distinct “archetypes” based on real case studies from the financial independence community. These stories illustrate that there is no single path to Coasting—only the path that works for you.

Story #1: The High-Earner Who Broke the “Golden Handcuffs”

Subject: Mark, age 34 Former Career: Software Sales New Career: High School History Teacher

The Background

Mark followed the standard script of success. By age 25, he was working in tech sales in San Francisco. By 30, he was earning over $180,000 a year. On the outside, he was winning. He had the luxury apartment, the nice watch, and the expensive dinners.

On the inside, he was miserable. The pressure to hit quarterly quotas was giving him insomnia. He felt like a cog in a machine, missing out on life while chasing a bonus check he didn’t have time to spend.

The “Aha!” Moment

Mark realized he was trapped in “Lifestyle Creep.” He was earning high figures, but spending high figures to cope with the stress. He stumbled upon the concept of Coast FIRE and ran his numbers.

He realized that over the last 8 years, he had aggressively saved $450,000 in his 401(k) and brokerage accounts.

- His Calculation: If he never saved another penny, that $450,000 would grow (at a conservative 7% return) to over $3.6 million by age 65.

He was grinding for a future that was already paid for.

The Coast FIRE Transition

Mark didn’t want to stop working; he just wanted to stop hating work. He had always loved history and mentoring kids.

At age 32, he quit his tech job. He moved to a medium-cost-of-living city and took a job as a high school history teacher earning $55,000 a year.

- The Result: His teacher salary covers his rent, groceries, and travel. He saves $0 per month for retirement, but he is happier than he has ever been. He has summers off, sleeps 8 hours a night, and has reclaimed his life three decades early.

The Lesson: Coast FIRE allows you to trade a high salary for high job satisfaction. You don’t have to retire to escape a toxic career; you just need to reach your Coast number.

Story #2: The “Late” Starter Who Used Geography

Subject: Elena and David, ages 41 and 43 Former Career: Marketing Manager & Project Manager New Career: Freelance Consultants (Part-time)

The Background

Elena and David felt they were late to the party. They spent their 20s paying off student loans and didn’t start seriously investing until their early 30s. Living in New York City, their cost of living was astronomical.

They felt that traditional FIRE (saving $2.5 million) was impossible. They were burned out and tired of the two-hour commute, but they only had about $300,000 combined in retirement savings. In NYC terms, that felt like nothing.

The “Aha!” Moment

They realized their problem wasn’t their savings; it was their expenses. Their Coast FIRE number was calculated based on their expensive NYC lifestyle. If they lowered their cost of living, their “enough” number would drop drastically.

The Coast FIRE Transition

They executed a strategy known as Geo-Arbitrage.

- They sold their small apartment and moved to a lower-cost area in Portugal (though this works equally well moving from New York to Ohio).

- Their monthly expenses dropped from $8,000 to $2,500.

- With $300,000 compounding in the background, they realized they were already Coast FIRE ready for a comfortable retirement if they maintained their new lower cost of living.

Today, they work freelance about 15–20 hours a week online. This covers their daily life in Portugal, allowing them to spend their afternoons surfing and learning a new language.

The Lesson: You can hit your Coast FIRE number faster by moving the goalposts. If you are willing to change where you live, you can change how you live almost immediately.

Story #3: The Hourly Worker Who Started Early

Subject: Sarah, age 29 Career: Barista & Seasonal Park Ranger

The Background

There is a myth that FIRE is only for tech bros and doctors. Sarah proves that wrong. Sarah never earned more than $45,000 a year. However, she had one massive advantage: Time.

She started investing at age 19. While her friends were buying new cars on credit, Sarah drove a 10-year-old Honda and put $500 a month into a total market index fund. She lived with roommates to keep rent low.

The “Aha!” Moment

By age 29, Sarah had saved $125,000. It doesn’t sound like a fortune compared to Mark’s $450,000, but because Sarah is so young, that money has 36 years to grow before she turns 65.

- $125,000 growing at 7% for 36 years = ~$1.4 Million.

Sarah realized that for her simple lifestyle, she was done. She had secured her retirement before she turned 30, all without ever earning a high salary.

The Coast FIRE Transition

Sarah loves nature. Instead of trying to climb a corporate ladder she didn’t care about, she embraced “Barista FIRE” (a cousin of Coast FIRE). She works seasonally as a park ranger in national parks during the summer and works at coffee shops in the winter.

She earns just enough to cover her annual spending of $30,000. She is “poor” by IRS standards, but she is “wealthy” in time. She hikes every weekend and has zero financial stress because she knows her nest egg is baking in the background.

The Lesson: You don’t need a six-figure income to Coast. You need consistency. Starting early (even with small amounts) is more powerful than starting late with large amounts.

The Common Threads: What Did They Do Right?

Looking at Mark, Elena, David, and Sarah, we see very different lives. However, if we look under the hood, they all followed the same four steps to reach financial independence early.

1. They Front-Loaded the Pain

None of them “coasted” from day one. They all had a period of high intensity. Mark endured the stress of sales; Elena and David paid off debt aggressively; Sarah lived with roommates and saved while earning low wages. You have to push the heavy snowball up the hill before you can let it roll down.

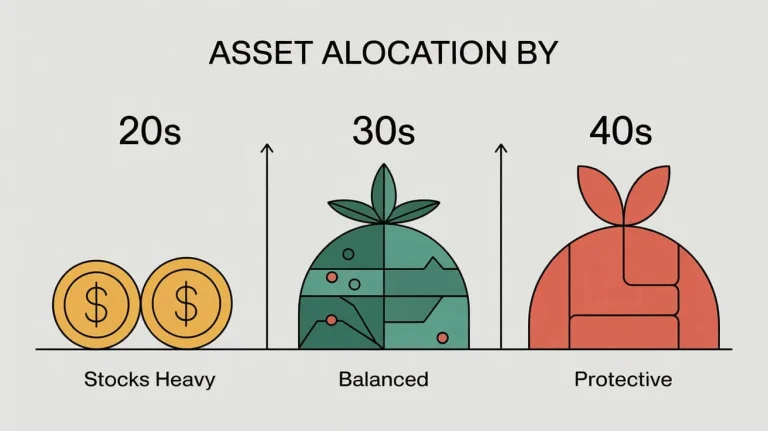

2. They Embraced Index Funds

None of these people were stock-picking geniuses. They didn’t get rich on crypto or a lucky IPO. They consistently bought boring, low-cost index funds (like S&P 500 funds or Total Market funds). They trusted the market’s historical average to do the heavy lifting.

3. They Decoupled Spending from Income

When Mark got a raise, he didn’t buy a Porsche. When Sarah worked overtime, she didn’t upgrade her apartment. The most critical habit for reaching Coast FIRE is avoiding lifestyle creep. If you spend everything you earn, you can never coast because your “required number” keeps getting higher.

4. They Viewed Money as a Tool, Not a Scoreboard

In the traditional finance world, the person with the most money wins. In the Coast FIRE world, the person with the most freedom wins. All of these individuals were willing to see their net worth growth slow down (by stopping contributions) in exchange for reclaiming their time immediately.

How to Write Your Own Story

You might be reading this thinking, “That’s great for them, but what about me?”

You are closer than you think. Here is the step-by-step blueprint to becoming the next case study on this website.

Step 1: Calculate Your “Freedom Number”

You cannot hit a target you cannot see. Go to our homepage at coastfirecalc.com and input your details.

- Be realistic about your spending.

- Be conservative with your growth rate (we suggest 6-7% inflation-adjusted).

Step 2: Fill the Gap

If you haven’t reached your Coast number yet, calculate the gap.

- Example: “I need $300k to Coast, but I only have $200k.”

- Make a plan to bridge that $100k gap. Can you do a “sprint” for 2 years? Can you pick up a side hustle?

Step 3: Test Drive the Lifestyle

Before you quit your job, practice the spending. If you plan to Coast on $40,000 a year, try living on $40,000 a year for 6 months while still earning your high salary. Bank the rest. This proves to your brain that you can be happy with less, reducing the fear of the leap.

Step 4: Build a Cash Buffer

This is the safety net. Before you switch to a lower-paying job or freelance work, ensure you have 6–12 months of expenses in a high-yield savings account. This prevents you from having to raid your retirement funds if your “Coast job” doesn’t work out immediately.

Conclusion: Your Life is Happening Now

The tragedy of the modern financial system is that it convinces us to trade the best years of our lives—our youth and vitality—for a retirement we might not be healthy enough to enjoy.

These stories show us a different way. Mark is teaching history now. Elena is surfing in Portugal now. Sarah is hiking the Rockies now. They didn’t wait for permission, and they didn’t wait for age 65.

They simply did the math, trusted the process, and realized that once the future was secure, they were free to live in the present.

Are you ready to see how close you are to freedom? Check your status instantly with our Coast FIRE Calculator. The life you want might be just a few compound interest points away.