What Is Coast FIRE? A Simple Explanation With a Real Example

If you have heard about FIRE but feel overwhelmed by aggressive saving and early retirement pressure, Coast FIRE may be a better fit for you.

Coast FIRE is a more relaxed approach to financial independence. It focuses on investing early, letting time do the heavy lifting, and giving you more freedom during your working years. Instead of racing to retire as soon as possible, you aim to make sure your retirement is already funded, then you simply maintain your lifestyle.

This article explains Coast FIRE in plain language, shows how the numbers work, and helps you understand whether it makes sense for your situation.

What Does Coast FIRE Actually Mean?

Coast FIRE means you already have enough invested today that, if you stop adding new money, your investments should still grow enough to cover your retirement in the future.

Once you reach this point, you do not need to save for retirement anymore. You only need to earn enough to pay your current bills. Your retirement is handled by compound growth over time.

You are not retired. You are not living off your investments yet. You are simply on track—and that changes how you think about work, money, and stress.

How Coast FIRE Is Different From Traditional FIRE

Traditional FIRE is about reaching a large investment number as fast as possible so you can stop working completely. This often requires saving a very high percentage of income and making lifestyle sacrifices for many years.

Coast FIRE works differently. You save aggressively early on, usually in your 20s or early 30s. After that, you ease off. You may still work full-time, or you may switch to lower-stress or lower-paying work, because retirement is already taken care of mathematically.

In simple terms, traditional FIRE buys freedom now. Coast FIRE buys freedom later, with less pressure today.

A Real Coast FIRE Example

Let’s walk through a simple example to make this clear.

Imagine you are 30 years old and want to retire at 65. You estimate that you will need about $40,000 per year in retirement. Using the common 4% rule, that means your retirement portfolio needs to be around $1,000,000.

Now comes the key question:

How much money do you need today so that it grows to $1,000,000 by age 65, assuming long-term market growth?

With a reasonable real return assumption, that number is roughly $180,000–$190,000.

If you already have that amount invested at age 30, you have reached Coast FIRE. Even if you never add another dollar to your retirement accounts, time and compound growth should carry you to your retirement goal.

This is exactly what a Coast FIRE calculator helps you determine based on your age, spending goal, expected return, and retirement age.

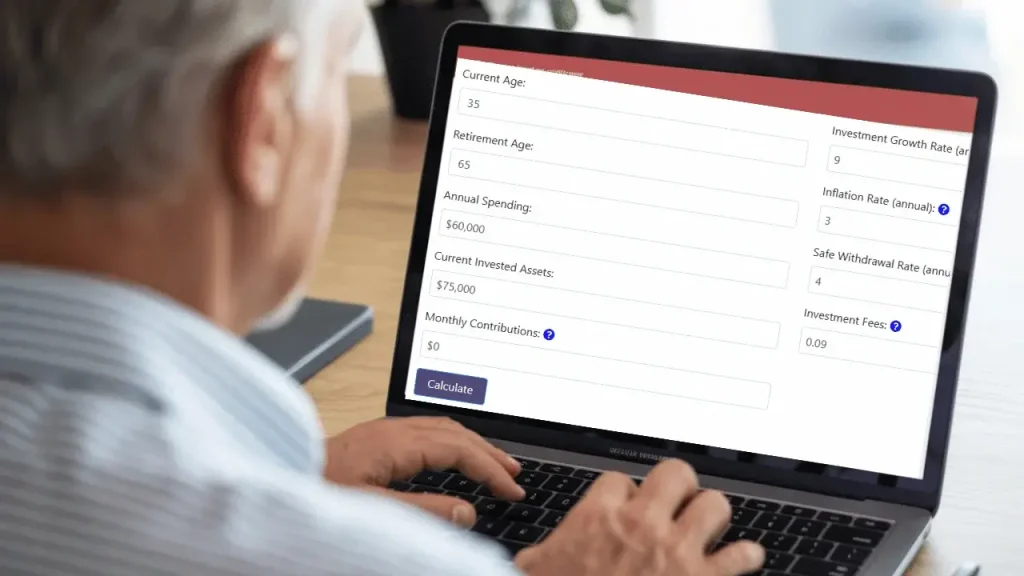

How a Coast FIRE Calculator Fits In

A Coast FIRE calculator works backward from your retirement goal.

You enter your current age, how much you plan to spend in retirement, when you want to retire, and an estimated investment return. The calculator then shows how much you need invested today to safely “coast” to retirement.

This approach is far more accurate than guessing or using rough rules, because even small changes in assumptions can make a big difference over decades.

Knowing your Coast FIRE number gives you clarity. You immediately see whether you are already there, close, or still need more time and savings.

Why Many People Choose Coast FIRE

People are drawn to Coast FIRE because it removes constant financial pressure.

Once retirement is mathematically handled, work becomes a choice rather than a trap. You can focus on balance, health, family, or meaningful work without feeling like every career move must maximize income.

For many, the biggest benefit is peace of mind. You no longer worry about whether you are “doing enough” for retirement. You know the numbers work.

Common Misunderstandings About Coast FIRE

One common misunderstanding is that Coast FIRE means you stop investing forever. In reality, many people continue investing when they can. Coast FIRE simply means you no longer have to.

Another misconception is that Coast FIRE is only for high earners. While income helps, starting early matters more. Time is the most powerful factor in this strategy.

Some also believe Coast FIRE means you are financially independent. That is not true. You still rely on income for living expenses. The difference is that retirement no longer depends on future savings.

Is Coast FIRE Right for You?

Coast FIRE tends to work best for people who start investing early and value flexibility over early retirement. It is especially appealing if you want to reduce burnout or avoid extreme frugality.

If you are starting much later in life or want to stop working as soon as possible, traditional FIRE may be a better fit. Coast FIRE is about sustainability, not speed.

Final Thoughts

Coast FIRE is not about quitting work. It is about removing pressure.

By investing enough early, you give yourself options. You gain time, flexibility, and confidence that your future is secure. For many people, this balance makes Coast FIRE one of the most realistic paths to financial independence.

If you want to know where you stand, calculating your Coast FIRE number is the best place to start.