Coast FIRE vs. Lean FIRE vs. Fat FIRE: Which Financial Freedom Path Is Right for You?

If you’ve spent any time browsing personal finance forums, Reddit, or financial blogs, you’ve likely caught the “FIRE” bug. The concept of “Financial Independence, Retire Early” is intoxicating. The idea that you don’t have to grind away at a desk until you’re 65 just to enjoy the last few decades of your life appeals to almost everyone.

But as you dive deeper, the waters get murky. You start seeing terms tossed around like salad ingredients: Lean FIRE, Fat FIRE, Barista FIRE, and our personal favorite here at CoastFireCalc.com, Coast FIRE.

Suddenly, a simple goal—freedom—becomes a complicated menu of choices.

If you feel overwhelmed, you aren’t alone. Many people stall on their financial journey because they don’t know which target they are aiming for. Are you supposed to live like a monk on a shoestring budget to retire at 30? Or do you need $5 million in the bank to maintain a luxurious lifestyle?

The truth is, FIRE is not a one-size-fits-all sweater. It’s a tailored suit. What works for a single software engineer in Seattle will not work for a family of four in the Midwest.

In this definitive guide, we are going to cut through the jargon. We will explore the three most popular “flavors” of FIRE—Lean, Fat, and Coast—breaking down the math, the required lifestyle changes, and the psychological reality of each. By the end, you’ll have a clear picture of which path aligns with your values and your wallet.

The Baseline: Traditional FIRE

Before we compare the variations, let’s establish the baseline.

Traditional financial independence relies on a simple rule of thumb known as the 25x Rule (derived from the 4% Safe Withdrawal Rate). The idea is simple: once you have saved 25 times your annual expenses in investments, you are mathematically “financially independent.” You can theoretically withdraw 4% of that portfolio in year one, adjust for inflation annually, and never run out of money for at least 30 years.

- If you spend $50,000 a year, your Traditional FIRE number is $1.25 million.

Lean, Fat, and Coast FIRE are all essentially variations of this math, adjusted for how much you want to spend and how hard you want to work to get there.

1. Lean FIRE: The Minimalist Approach

Lean FIRE is the “hardcore mode” of the movement. It is driven by a desire to exit the rat race as fast as humanly possible, usually by adopting a lifestyle of extreme frugality.

The Definition and The Math

Lean FIRE adherents generally aim to live on significantly less than the average household—often classified as annual spending of $40,000 or less for a household (sometimes much less for individuals).

Because their annual expenses are so low, their required “nest egg” is smaller and faster to achieve.

- Target Annual Spend: < $40,000

- The Nest Egg: $800,000 to $1 million.

The Lifestyle: Spartan and Disciplined

The Lean FIRE lifestyle is not for everyone. It requires intense discipline. We’re talking about things like optimizing grocery bills down to the cent, rarely eating out, perhaps living in a smaller home or a lower-cost-of-living area, and relying heavily on DIY skills rather than paying for services.

For some, this is liberation from consumerism. They genuinely find happiness in simplicity. For others, it feels like a perpetual state of deprivation.

Who Is Lean FIRE For?

Lean FIRE is best suited for naturally frugal minimalists who value time over things to an extreme degree. It is often pursued by younger singles or couples without children who hate their current jobs so much that they are willing to sacrifice almost all luxuries to escape within 5–10 years.

The Risks: Lean budgets have very little wiggle room. A major unexpected medical issue, hyperinflation, or a significant change in life circumstances (like having triplets) can break a Lean FIRE plan quickly.

2. Fat FIRE: The Luxurious Approach

On the complete opposite end of the spectrum is Fat FIRE. If Lean FIRE is about eating rice and beans to retire at 30, Fat FIRE is about eating steak and lobster and retiring at 45.

The Definition and The Math

Fat FIRE is for those who want financial independence without having to compromise their lifestyle. They want to travel internationally in comfort, drive nice cars, live in high-cost-of-living cities, and never worry about the price of guacamole.

This requires a massive portfolio. Fat FIRE is generally defined as a retirement spending budget of $100,000+ per year (often significantly more).

- Target Annual Spend: $100,000 – $250,000+

- The Nest Egg: $2.5 million to $6 million+.

The Lifestyle: Abundance and High Income

To achieve Fat FIRE, you almost certainly need a very high income during your working years. We are usually talking about dual-income professional households (doctors, lawyers, high-level tech workers) or successful business owners.

You are saving aggressively, but because your income is so high, you don’t necessarily feel frugal. You can still take nice vacations and buy what you want, as long as you are shoveling huge amounts of cash into investments.

Who Is Fat FIRE For?

This path is for high earners who enjoy the finer things in life and aren’t willing to give them up just to retire a few years earlier. They are willing to work longer in high-stress careers to ensure their eventual retirement is incredibly comfortable and cushioned against almost any financial shock.

The Risks: The biggest risk is “One More Year Syndrome.” Because the target number is so huge, people often keep working long after they need to, terrified of stepping away from their high salaries.

3. Coast FIRE: The Balanced, Sustainable Approach

Now we arrive at Coast FIRE. This is often described as the “Goldilocks” option—not too hot, not too cold. It bridges the gap between the extreme sacrifice of Lean FIRE and the extreme accumulation of Fat FIRE.

Full disclosure: As the team behind CoastFireCalc.com, this is our favorite approach because it focuses on mental health and immediate flexibility.

The Definition and The Math

Lean and Fat FIRE are about reaching a final number and stopping work completely.

Coast FIRE is different. You don’t stop working. Instead, you save aggressively early in your career until you reach a specific “tipping point.” Once you hit that number, you stop contributing to your retirement accounts entirely. You let that initial snowball sit there and compound for decades.

Because you no longer need to save for the future, your monthly financial obligation drops massively. You only need to earn enough money to cover your current living expenses.

- The Math: It’s complicated, as it depends on your current age and retirement age. (Use our Coast FIRE Calculator to find your exact number).

- The Goal: Reach a point where, even if you never save another dime, your current investments will grow to be a traditional retirement nest egg at age 65.

The Lifestyle: Flexibility and “Semi-Retirement”

Coast FIRE doesn’t mean you hit the beach at 35. It means you gain autonomy at 35.

Once you hit your Coast number, the pressure is off. You might quit your high-stress, 60-hour-a-week corporate job to take a lower-paying, more fulfilling job. Maybe you drop to part-time work. Maybe you start that freelance business you’ve always dreamed of.

You are still working to pay your rent and buy groceries, but you aren’t working to fund your 401k anymore. The heavy lifting is done.

Who Is Coast FIRE For?

Coast FIRE is ideal for people who don’t necessarily hate working, they just hate the pressure of their current high-stakes careers. It’s for people who want a better work-life balance now, in their 30s and 40s, rather than waiting until their 50s or 60s. It’s a sustainable marathon, not a sprint.

The Risks: The main risk is psychological. It is very hard to stop saving after years of aggressive frugality. You also need to ensure your “coasting job” still provides necessary benefits like health insurance, or factor those costs into your Coasting budget.

Comparison at a Glance

Here is a quick visual summary of how these three paths stack up against each other.

| Feature | Lean FIRE | Coast FIRE | Fat FIRE |

| Primary Goal | Retire ASAP | Flexibility & Work-Life Balance Now | luxurious Retirement |

| Annual Spend | < $40,000 (Frugal) | Varies (Covers current expenses) | > $100,000 (Lavish) |

| Nest Egg Needed | ~$800k – $1M | Varies based on age (Smaller than full FIRE) | ~$2.5M – $5M+ |

| Work Requirement | Stop working early | Continue working (often downshifted) | Work longer in high-income jobs |

| Sacrifice Level | High sacrifice now on spending | High sacrifice now on saving, low sacrifice later | Low sacrifice on spending, high sacrifice on working hours |

| Risk Profile | High (little margin for error) | Medium (reliant on market compounding) | Low (huge financial buffer) |

How to Decide: Which Path Is Right for You?

If you are still unsure which path to choose, it usually comes down to answering a few deeply personal questions about your values and your current situation.

Forget the math for a second. Let’s talk about psychology.

1. How much do you hate your current job?

- “It is soul-crushing and physically painful to go to work.” -> You probably want Lean FIRE. The goal is escape at any cost.

- “It’s okay, pays well, but I’m stressed and missing my kids growing up.” -> Coast FIRE is likely your best bet. You need to downshift, not necessarily stop entirely.

- “I actually like my job, the status, and the money. I just want to know I could stop eventually.” -> You are a candidate for Fat FIRE.

2. What is your relationship with “stuff”?

Look at your credit card statement from last month.

- If the idea of cutting that spending by 50% makes you feel physically ill, Lean FIRE will make you miserable. Aim for Fat or Coast FIRE.

- If you look at your spending and realize half of it brought you no joy, you might have the minimalist mindset required for Lean FIRE.

3. What is your risk tolerance?

- Lean FIRE requires the assumption that nothing major will go wrong in the future. It operates on razor-thin margins.

- Fat FIRE has massive margins of safety built in.

- Coast FIRE sits in the middle, relying on long-term market performance to do the work for you.

Conclusion: The Best Plan is the One You Start

The beauty of the financial independence movement is that nothing is set in stone. You don’t have to declare your allegiance to “Team Lean” or “Team Fat” today and stick to it forever.

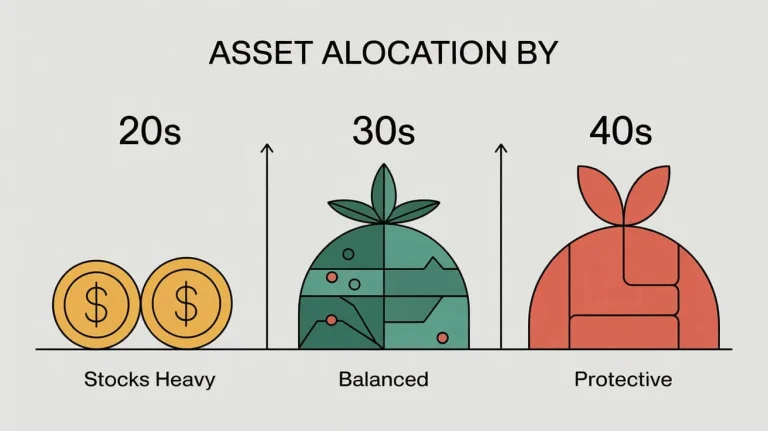

Many people start with the intensity of Lean FIRE in their 20s, realize it’s unsustainable, and transition into a Coast FIRE path in their 30s as their priorities shift toward family or balance. Others aim for Fat FIRE and realize halfway there that they have enough, deciding to Coast the rest of the way.

The most important step is simply beginning to save aggressively and understanding the math.

If the idea of needing $2.5 million to retire feels depressing, don’t give up. Look at Coast FIRE instead. You might find that the number you need to hit to change your life forever is much smaller—and closer—than you think.

Curious what your “tipping point” number is? Run your numbers for free on our homepage calculator now.